Are you currently receiving royalty income in Texas? Curious about how much you could get for selling? You’re not alone! We speak with a lot of royalty owners who want to know how much their royalties are worth. Regardless of whether you want to sell royalties in Texas or not, it doesn’t hurt to know how much your royalties are worth! The guide below will help you understand everything you need to know about the value of oil and gas royalties in Texas.

What are Oil and Gas Royalties?

Many royalty owners have been getting checks in the mail for years without really understanding what they are for. In it’s most basic sense, oil and gas royalties are payments for your share of the oil and gas produced out of the ground. While the calculations that take place to determine how much you get are complex, this is the most basic explanation of why you get paid royalties.

When you receive royalty checks each month, you are being paid for your share of the oil and gas that comes from a producing well. The reason your Oil and gas royalty checks fluctuate each month is because the price of oil and gas is constantly moving! In addition, the amount of oil and gas being produced out the ground varies each month. If oil prices are $65/barrel (like they are now), and your well only produces 200 barrels this month instead of the usual 400, it will substantially change how much you receive!

Why would my production fluctuate? The operator of the well you are being paid on might have a lot of good reasons to increase or reduce the amount of oil and gas produced. They want to re-work the well to increase production. This usually means the well is shut down for a few days or weeks to work on it. They might have an issue that has be be fixed “down hole”, meaning they have a problem beneath the service. Some operators will even speculate on the price of oil and sell early or store for another month. These and other examples are ways your production, and as a result your monthly royalty income may vary.

How to calculate Oil and Gas Royalties Value in Texas

Now that you know why you are receiving royalties and how it can fluctuate, it’s time to calculate how much you would receive for selling the income from your oil and gas royalties. Generally speaking, you can expect to get paid anywhere from 4 years to 6 years times the average amount you receive each month. All you need to know to calculate royalties value is the average amount you receive each month.

HOWEVER, please take important note that in many counties in Texas, this calculator can be a very poor estimate of value. It is the industry standard calculation for oil and gas royalties with very little future value. If you are using this calculator to estimate a possible sales value, most counties in Texas have future value and many significant extra value!

Royalty Calculator: You can quickly get an estimate of royalties value in Texas using the calculator below. Using our example from above, let’s pretend that you receive $1,000/month in royalty checks. If you put that amount in the first box below, you will see that selling royalties in Texas should be worth anywhere from $48,000 to $72,000.

Wow! Pretty big range for how much selling royalties with very little future upside in Texas could be worth! The reason the range is so large is because there are a number of factors that can affect the value of royalties in Texas. Each of these will play a role in how much you could sell oil and gas royalties in Texas for.

Factors Affecting Oil and Gas Royalties Value in Texas

The reason that the price range is so large above is because the value of royalties is affected by a lot of different factors. When and oil and gas investors makes an offer to buy royalties, they are going to take each of the factors below into consideration. Depending on your specific property, these factors could help or hurt the value of your property. In many cases you could actually get substantially more than the top end the calculator shows above so be sure and get expert help before accepting any offers! Here are some the factors that will affect the Value of Oil and Gas Royalties in Texas:

Oil and Gas Prices: Since oil and gas prices play such a significant role in how much you receive each month for your royalty checks, the price of oil and gas plays a large role. When a buyer wants to purchase your property, they will be paying close attention to oil and gas pricing. However, oil and gas investors are aware that the price of oil moves up and down. They will take that into consideration when making an offer to purchase royalties in Texas.

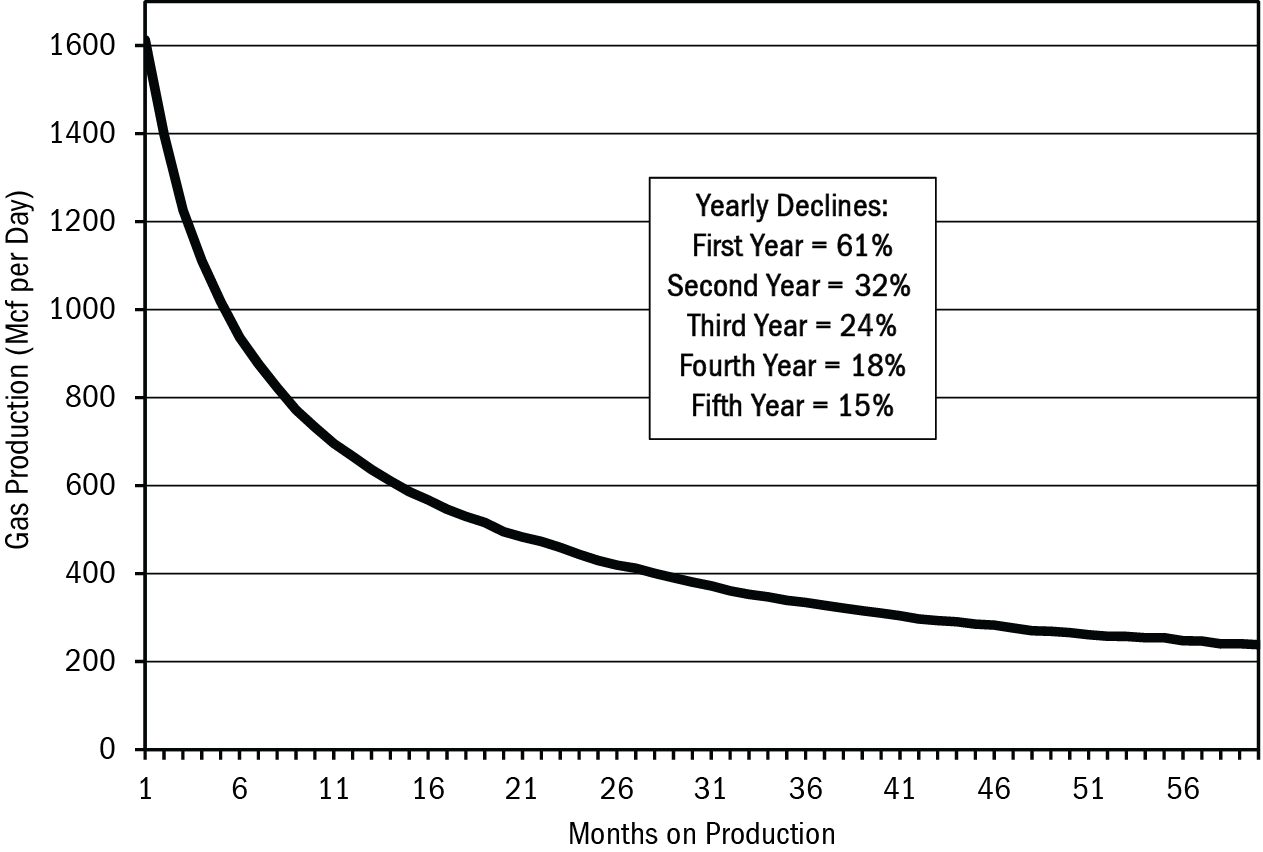

Age of Production: Another key indicator investors use to value oil and gas royalties in Texas is to look at the age of production. If your well had been producing royalties for 50 years, it’s likely that the well has worked through a large portion of it’s productive life. All wells eventually decline in value over time and eventually are no longer profitable to operate. If your well is past the initial decline and still has many years of productive life remaining, a buyer is going to be willing to pay a higher price. Note in the chart below how the production slowly declines over time until it eventually levels out at much lower level after the first 5 years.

Initial Decline: Many royalty owners make the mistake of basing the value of royalties they receive very high based on the first 12 month to 24 months of production. You can clearly see in the graph above that the first 12 to 24 months will produce much higher (meaning higher royalty checks) during this time frame. Oil and Gas investors know that there is always an initial decline and will base their offers accordingly.

Competition: If you want to get the highest possible price for selling your royalties, make sure there are multiple buyers who are making bids on your property. When a buyer knows that you are only talking to them, they try and offer you the least amount possible.

There is an old saying….”pay only what you have to, not what you can”.

Since they know you likely aren’t sure what the value is, most buyers will make every effort to purchase your property for the least amount possible. To ensure a successful sale, you must get the highest price for your oil and gas royalties in Texas by marketing the property to a huge audience of buyers. We recommend you list your property through a company like US Mineral Exchange to get maximum exposure.

Surrounding Production: While you can’t base the value of your royalties completely on what’s around you, good production in the area helps. If the wells in your area are producing a lot of oil and gas, there will be additional interest in your royalties simply because many buyers are focused on the area.

Future Drilling Potential: The single biggest factor that will help you get more than 6 years of production is if there is future drilling potential. This is especially true if you own a lot of net mineral acres that make up your current royalty. We have seen value’s over 100 years of current production because the mineral rights that were producing were in a great county and had a lot going on around them. You won’t know for sure how much your royalties are worth until you put them on the market for sale. It really is the only way.

How to Sell Oil and Gas Royalties in Texas

Want to sell oil and gas royalties in Texas? If you want to get the highest possible value there’s one important thing to remember. You will never get the highest value working with one or two buyers. Why is this true? Think about it this way. Let’s pretend that you are going to sell a home and you put a sign in your front lawn, but you live in an area without much traffic. Only one or two buyers who are even in the market ever pass by your house. Would you expect to get the best possible price? No way!!!

Now imagine that you list your home on the MLS where it gets exposure to thousands of buyers from all over your city who are in the market for a property. Wouldn’t you get a lot more activity if thousands of buyers knew you property was available? Of course you would! Mineral rights are no different. You don’t want to submit your information to a couple websites and hope for the best. You want to get your property in front of a large audience of buyers who will compete against one another to pay you the highest price.

Best Way to Sell Oil and Gas Royalties in Texas

Our recommendation for the best way to sell oil and gas royalties in Texas is to list your property at US Mineral Exchange. Why? We consistently recommend them for the following reasons:

- Communication: When you list your property at US Mineral Exchange, they will be in constant communication with you about what’s happening with your property. In addition, they will always be around to help answer your question and guide you through the process.

- Trustworthy: If you do a quick google search for sell texas royalties, you will find hundreds of websites offering to buy. Who are these people? How do you know you are getting the best price and not getting taken advantage of? You don’t unfortunately.

- Large Pool of Buyers: The main reason we recommend US Mineral Exchange is because their service allows you to get your property in front of a large audience of mineral rights buyers. If you want to get the best possible price, we recommend their service.

- Customer Reviews: A quick review of their actual customer reviews tells the tale. Unlike other services who simply slap a few “testimonials” on their site, you can verify actual customer reviews quickly. We all know how reviews work. To have a 5 star rating on Google with most customer reviews across every industry written as negative, is outstanding.